Get ready for a new era of MPF management with the launch of the eMPF Platform (the eMPF) on 26 June. Whether you’re an employer or an employee, with the eMPF mobile application or online portal, you can now handle all your MPF administration tasks anytime, anywhere. Say goodbye to the hassle of managing MPF through different trustees’ separate administrative systems – The eMPF is here to make things a breeze!

To enjoy the full benefits of the eMPF, 4 key points you should never miss:

- Effortless operation

If you have enrolled in multiple MPF schemes, you may have the experience of managing MPF with separate administration systems of different trustees, which is undoubtedly a tedious and time-consuming process.

The eMPF is here to centralize and streamline the administration procedures, bringing you a brand new MPF management experience on a single platform with greater convenience and lower fees. It is projected that, within the first two years of operation, the average MPF administration fee can be reduced by 36%. This is estimated to generate HK$30 billion to HK$40 billion in cumulative administration cost savings over the next ten years, equivalent to a 41% to 55% cut on the original administration fee. For every $1 of administration fee, it is expected to be $0.45 in the future.

In addition to fee reduction, when all MPF schemes get onboard the eMPF, the handling of all MPF administrative instructions will be centralized, and all MPF administrative instructions can be made via the eMPF anytime, anywhere, leading greater convenience and efficiency in MPF management. Forgot which MPF schemes you have enrolled in the past? It will not be a problem anymore as scheme members can view all their MPF account balances and performance under different schemes on the eMPF at one glance. The process of account consolidation will be half the time of the current system, which can take up to three weeks.

- Sufficient support

A simpler administration process of the MPF System is particularly important for small and medium-sized enterprises with limited manpower. Employers can leverage automatic contribution calculation and reminder functions on the eMPF, reducing manual errors and improving overall efficiency. The digitalized platform can also reduce paper consumption, simultaneously lowering operating costs.

Once their MPF schemes get onboard the eMPF, individuals and companies will no longer manage their MPF accounts using their trustees’ administration platforms. Employers need not to worry about navigating the eMPF as outreach services provided by the contractor are available by appointment. The three eMPF Service Centres and a total of 12 self-service kiosks (click here for the location details), are also ready to provide support and assistance to those who need help. Details of these support services are available on the eMPF website.

- eMPF – the only MPF administration platform

Employers and scheme members can centralize the handling of various MPF administrative instructions such as account consolidation, contributions, fund switches, and withdrawals under a single eMPF account, streamlining the process for greater convenience and efficiency.

While submitting MPF administrative instructions in paper forms is still an option, handling MPF administrative tasks electronically on eMPF is far more efficient. To employers, it is particularly useful. After their respective MPF schemes have onboarded the eMPF, their company’s relevant information, including current employee details, salary groups, and direct debit arrangements, will be automatically transferred from the trustee’s system to the eMPF saving time and effort, and avoiding human errors.

To enjoy the benefits of the eMPF, the first step is to register. Let’s watch the below tutorials to learn the easy steps:

Employer: https://empf.org.hk/er/tutorial/reg/en

Employee: https://empf.org.hk/tutorial/reg/en

It is also important to note that registration only needs to be carried out once, even if you have joined more than one MPF schemes. For any queries, contact the eMPF Customer Service through the following channels:

Email: enquiry@support.empf.org.hk

Hotline: 183 2622

Hotline’s manned service hours: Monday to Friday, 9am to 7pm; Saturday, 9am to 1pm (excluding public holidays)

- No rush! Wait for your turn!

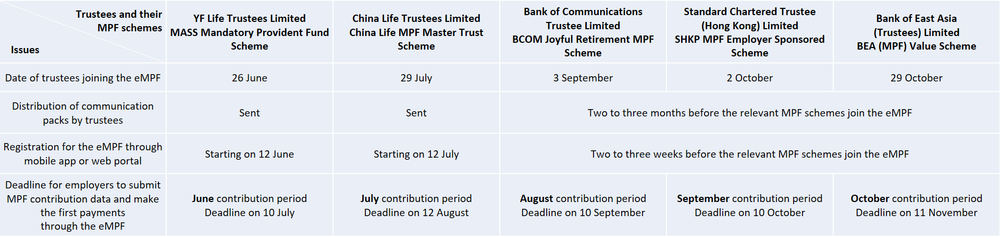

Starting in June 2024, MPF schemes are joining the eMPF one by one in ascending order according to the size of MPF assets under management by trustees. All schemes are expected to join eMPF by the end of 2025.

Scheme members and employers should keep a close eye on communication materials from their respective trustees. Trustees will send out the communication pack two to three months before their schemes get onboard, providing an outline on important procedures and deadlines, such as the onboarding date, registration commencement date, and cut-off dates for submitting various MPF administrative instructions.

Scheme members and employers will not be able to view their MPF account information or submit any administrative instructions on the eMPF until their respective schemes have got onboard.

Check out the onboarding dates of the first five MPF schemes joining the eMPF!

- Mass Mandatory Provident Fund Scheme: 26 June 2024

- China Life MPF Master Trust Scheme: 29 July 2024

- BCOM Joyful Retirement MPF Scheme: 3 September 2024

- SHKP MPF Employer Sponsored Scheme: 2 October 2024

- BEA (MPF) Value Scheme: 29 October 2024

More information about the onboarding schedule can be found here.